Company Review

Apple Inc. is an American international innovation business headquartered in Cupertino, The golden state. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple initially focused on desktop computers. Over the years, it has broadened right into various customer electronics, software program, and on the internet solutions.

Key Products:

- iPhone

- iPad

- Mac computers

- Apple Watch

- Apple television

- Operating systems: iphone, macOS, watchOS, tvOS

- Services: App Shop, Apple Songs, iCloud, Apple Pay, Apple TV+

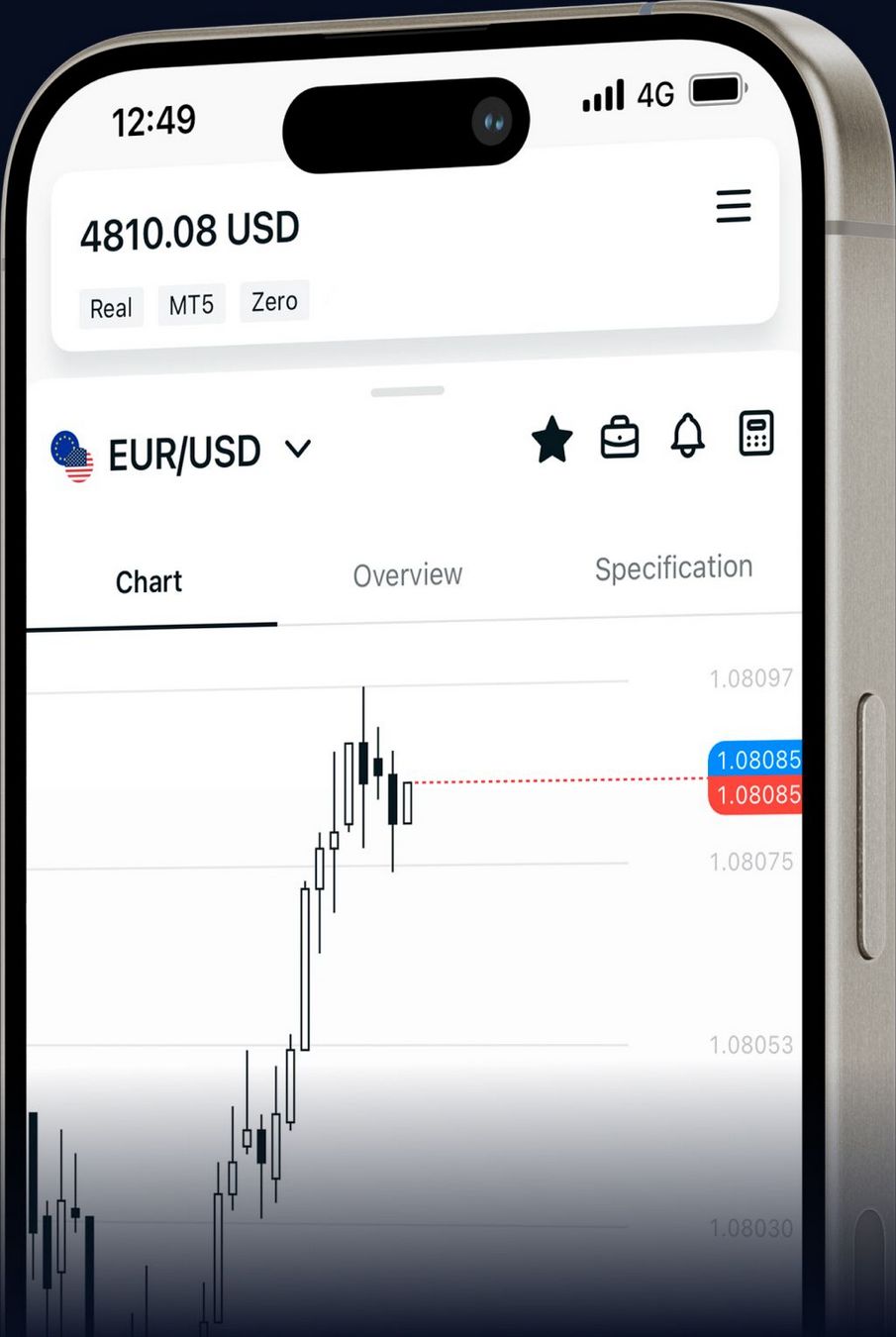

Exactly How to Buy Apple Shares in India through Exness

Exness, a leading on-line trading system, provides Indian financiers with the opportunity to get Apple shares. Here’s a detailed overview:

-

Open up an Exness account:

- Check out the Exness internet site and enroll in an account.

- Complete the Know Your Client (KYC) process by submitting the needed files.

-

Down payment funds:

- Transfer the desired investment amount into your Exness trading account.

- Available repayment approaches include bank transfer and UPI.

-

Select Apple shares:

- In the Exness trading system, look for Apple shares (AAPL).

-

Place an order:

- Make a decision the number of shares you want to get.

- Set the order kind (market or restriction).

- Area the order.

-

Validate acquisition:

- Review the order information.

- Validate the acquisition.

- The shares will be attributed to your trading account when the order is performed.

-

Monitor financial investment:

- Keep track of your financial investment via the Exness platform.

- Handle your portfolio appropriately.

follow the link Exness in India At our site

Market Circumstance

Apple runs in the extremely affordable customer electronics and innovation industry. Significant competitors consist of Samsung, Google (Alphabet Inc.), Microsoft, and Amazon. In spite of intense competitors, Apple preserves a solid market position, especially in mobile phones and personal computing.

- The iPhone, introduced in 2007, revolutionized the mobile phone market and stays among the best-selling items globally.

- Apple’s approach stresses premium items, design top quality, and an incorporated ecological community, cultivating brand commitment.

- The business’s services section, including the App Shop, Apple Music, and iCloud, adds dramatically to its income.

Influencing Factors

Interior Aspects:

- Advancement and R&D Brand commitment

- Community assimilation External Variables: Market competition Economic problems Regulative

- atmosphere Expert

- Opinions John Doe, Elder Expert at Tech Insights:

Apple s

solid ecological community and technology pipe placement it well for ongoing development. The business s focus on expanding its services offerings and wearables sector is most likely to drive significant income growth in the coming years. Nevertheless, the success of brand-new item classifications like the Vision Pro headset will be critical in keeping Apple s market supremacy. Jane Smith, Market Planner at Future Trends: While Apple deals with&

intense competitors from various other tech giants, its brand strength

and consumer commitment stay unmatched in the industry. The introduction of the Vision Pro and advancements in enhanced fact could open new earnings streams and solidify Apple s setting as a trendsetter. Nonetheless, the company has to browse potential regulative obstacles and supply chain difficulties successfully. Expert Group at Investment Financial Institution XYZ: Apple s financial health is durablewith a solid balance sheet and consistent cash flow generation. The business s solutions sector has actually shown remarkable growth, providing a secure profits stream enhancing its hardware sales. However, Apple needs to deal with enhancing governing scrutiny and geopolitical risks, especially concerning its supply chain dependences in China, to preserve its competitive edge and long-lasting profitability. Potential customers and Dangers Potential customers: Growth in Solutions: Apple s solutions sector, including Apple&

Music, Apple Television +, and

iCloud, shows substantial development potential as the company remains to increase its offerings and user base. Wearable Modern Technology: Products like the Apple Watch and AirPods remain to see solid demand, contributing to revenue diversity and positioning Apple as a leader in the wearables market. Development in AR/VR: The newly presented Vision Pro headset and developments in augmented fact(AR)and virtual reality(VR )innovations present new growth chances

- for Apple, permitting the firm to explore untapped markets and revolutionize customer experiences. Threats: Regulatory Difficulties: Boosting regulative analysis, particularly worrying antitrust issues, information personal privacy, and individual privacy, can impact Apple s procedures and strategies, potentially impeding its

- ability to introduce new products or services. Supply Chain Dependencies: Apple s heavy reliance on producing facilities in China and other regions positions threats related to geopolitical tensions, trade plans, and supply chain disruptions, which could influence item accessibility and prices. Market Saturation:’In essential markets like smart devices, market saturation and extreme competition might limit growth potential, necessitating the expedition of new item classifications and cutting-edge remedies to sustain income growth.

- Final thought Element Summary Current Share Cost$227.82 (as of July 9, 2025)Market Capitalization$3.2 trillion (as of June 2025)Competitive Positioning Solid market setting in smart devices, personal computer, and consumer electronic devices Development Possible Development in services, wearables

and AR/VR innovations

Dangers Regulatory

challenges, supply chain reliances

market saturation For financiers, Apple s

stock offers both significant development possibility and threats. Closely keeping track of the factors influencing the

business s performance and looking for specialist advice is suggested before making investment decisions. FAQ Q: What is Apple

present stock rate and market capitalization? A: As of July 9, 2025, Apple s

supply

rate is$227.82, with a market capitalization of$ 3.2 trillion. Q:

What are the major development prospects for Apple s stock? A: Secret development prospects include expansion in services, wearable modern technology, and technology in enhanced fact(AR )and virtual reality(VR )technologies. Q: What are the major threats connected with investing in

Apple s stock’? A: Regulative challenges, supply chain dependences, and market saturation in key product groups are amongst the main risks capitalists ought to think about.

How to buy Apple (AAPL) shares